In the quest for financial stability and security, mastering your finances is paramount. One powerful tool that can aid in this endeavor is the bill spreadsheet, a versatile and customizable resource for tracking expenses, managing budgets, and staying organized. In this comprehensive guide, we’ll explore the benefits of using free bill spreadsheets for effective money management and provide practical tips for maximizing their utility in your financial journey.

Understanding the Importance of Bill Spreadsheets:

At the core of sound financial management lies the ability to track expenses and monitor cash flow effectively. Bill spreadsheets offer a structured and systematic approach to organizing financial data, making it easier to understand spending patterns, identify areas for improvement, and set realistic budgeting goals.

Exploring the Features of Free Bill Spreadsheets:

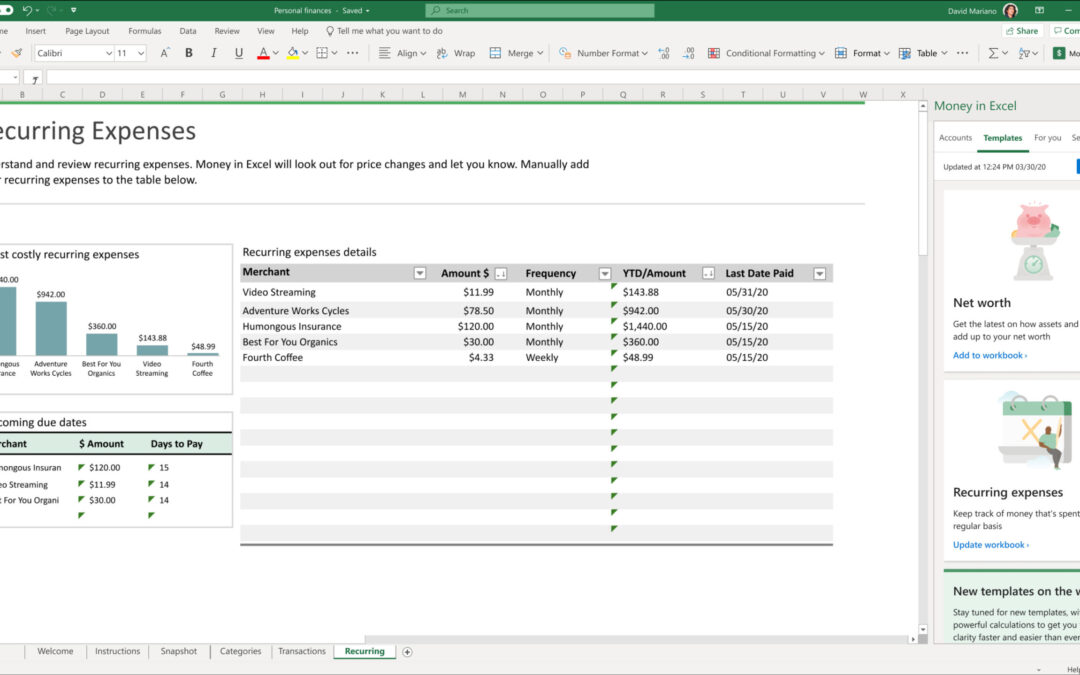

Free bill spreadsheets come in various formats and designs, each offering unique features and functionalities. Whether you prefer a simple monthly budget tracker or a comprehensive expense management tool, there are numerous options available online at no cost. These spreadsheets typically include categories for income, expenses, savings goals, and bill due dates, allowing users to input and analyze financial information with ease.

Benefits of Using Free Bill Spreadsheets:

The advantages of using free bill spreadsheets for money management are manifold. Firstly, they provide a centralized platform for consolidating financial data, eliminating the need for multiple disparate systems or manual record-keeping. Additionally, bill spreadsheets offer real-time visibility into financial transactions, enabling users to make informed decisions and adjust spending habits accordingly. Moreover, the customizable nature of these spreadsheets allows users to tailor them to their specific needs and preferences, ensuring a personalized and efficient money management system.

Practical Tips for Using Free Bill Spreadsheets Effectively:

To harness the full potential of free bill spreadsheets, consider implementing the following tips:

Regularly Update and Review:

Make it a habit to update your bill spreadsheet regularly with accurate and up-to-date financial information. Set aside time each week or month to review your expenses, reconcile accounts, and track progress towards your financial goals.

Categorize Expenses Thoughtfully:

Organize your expenses into meaningful categories to gain insights into your spending habits and identify areas for potential savings. Common categories may include housing, transportation, groceries, utilities, entertainment, and miscellaneous expenses.

Set Realistic Budgeting Goals:

Establish realistic budgeting goals based on your income, expenses, and financial priorities. Use your bill spreadsheet to track actual spending against budgeted amounts and make adjustments as needed to stay on track with your financial goals.

Take Advantage of Built-in Functions:

Familiarize yourself with the built-in functions and formulas available in your bill spreadsheet software. Utilize features such as sum functions, conditional formatting, and charts/graphs to analyze data, visualize trends, and gain deeper insights into your finances.

Utilize Payment Reminders and Alerts:

Leverage the reminder and alert features in your bill spreadsheet to stay on top of upcoming bill due dates and avoid late payments or missed deadlines. Set up automatic reminders or notifications to prompt you to take action when bills are due.

Explore Additional Resources and Templates:

Take advantage of the wealth of free resources and templates available online to enhance your bill spreadsheet experience. Many websites offer downloadable templates, tutorials, and guides to help you customize and optimize your spreadsheet for maximum effectiveness.

Track Your Progress Over Time:

Use your bill spreadsheet to track your financial progress over time and celebrate milestones along the way. Monitor changes in your income, expenses, and savings balance, and celebrate achievements as you work towards your long-term financial goals.

Conclusion:

In conclusion, free bill spreadsheets are invaluable resources for individuals seeking to take control of their finances and achieve their financial goals. By leveraging the features and functionalities of these versatile tools, users can track expenses, manage budgets, and make informed decisions with confidence and clarity. Whether you’re a budgeting novice or a seasoned financial planner, incorporating a free bill spreadsheet into your money management toolkit can pave the way for greater financial stability and success.

Recommended Article: Elevate Your Financial Strategy with Concat’s Finance Consulting Services