As a business owner or entrepreneur, handling payroll is one of your most important yet often challenging tasks. Ensuring your employees are paid accurately and on time is critical for maintaining a smooth operation and fostering trust. One of the best ways to streamline this process is by using a paystub generator. These online tools can save you hours of manual work, reduce the risk of errors, and ensure you remain compliant with tax regulations.

However, not all paystub generators are created equal. To help you find the right one for your business, it’s important to understand the key features you should look for. In this blog, we’ll cover the top features that make a paystub generator effective, as well as how they can save you time, money, and effort. Whether you’re a small business owner, startup entrepreneur, or freelancer, a reliable paystub generator can simplify your payroll process and keep things running smoothly.

What is a Paystub Generator?

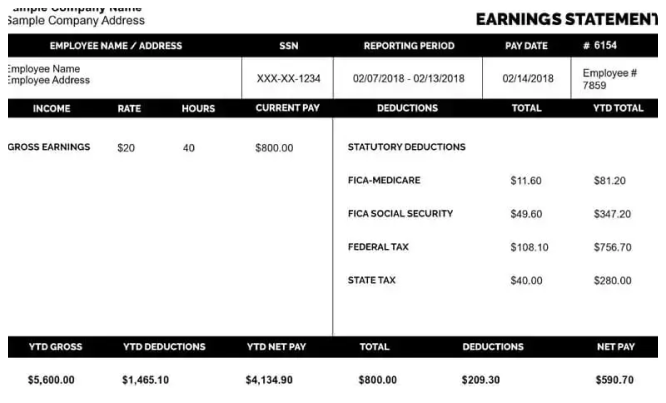

Before diving into the top features, let’s first define what a paystub generator is. A paystub generator is an online tool or software that allows business owners to create professional pay stubs for their employees. These pay stubs contain all the necessary details regarding an employee’s earnings, deductions, and taxes for a given pay period.

A paystub typically includes:

- Gross pay: Total earnings before deductions.

- Deductions: Taxes, insurance, retirement contributions, etc.

- Net pay: The final amount the employee takes home.

- Hours worked: For hourly employees, the total number of hours worked.

- Employer and employee details: Name, address, and other identifying information.

Paystub generators simplify the payroll process by automatically calculating these amounts, ensuring everything is accurate and up-to-date.

Top Features to Look for in a Paystub Generator

1. Ease of Use

One of the most important features of a paystub generator is ease of use. As a business owner, you likely have a lot of responsibilities on your plate. You need a tool that helps you quickly and efficiently generate pay stubs without a steep learning curve. A user-friendly paystub generator will have a simple interface, with clear instructions and easy-to-navigate features.

Look for a tool that offers:

- A straightforward setup process: You should be able to set up your account, enter company and employee information, and start creating pay stubs within minutes.

- Simple input fields: Most paystub generators allow you to enter essential details like employee names, pay rates, deductions, and hours worked using simple forms.

- Intuitive design: The interface should be clean and easy to understand. There should be no confusion about where to enter specific data or how to generate a pay stub.

2. Customization Options

Every business has its own specific needs, so it’s important to have a paystub generator that can be customized to suit your company’s unique requirements. Customization options help you create pay stubs that reflect your brand identity and adhere to your payroll practices.

Features to look for include:

- Company logo and branding: A good paystub generator should allow you to upload your company logo, customize the font, and adjust the overall design to match your branding.

- Customizable pay stub templates: You might need to add extra fields or remove unnecessary ones depending on the nature of your business. Some paystub generators offer templates that can be tailored to your needs.

- Different pay periods: The ability to customize for different pay periods (weekly, bi-weekly, monthly, etc.) ensures that your pay stubs reflect your company’s payment schedule.

3. Tax Calculation and Compliance

Keeping up with tax laws is one of the most complex aspects of payroll. Tax calculation must be accurate, as mistakes can lead to serious consequences, including fines and penalties from the IRS. This is why an effective paystub generator should have automated tax calculation capabilities to ensure your payroll is always compliant with federal, state, and local tax regulations.

Look for the following features:

- Automatic tax calculations: A reliable paystub generator should automatically calculate federal, state, and local taxes based on the employee’s income and location. It should include tax brackets, FICA (Social Security and Medicare), and other required deductions.

- Up-to-date tax rates: Make sure the paystub generator is regularly updated to reflect any changes in tax rates or regulations.

- Custom deduction options: You should be able to input various deductions, such as retirement contributions, health insurance premiums, or wage garnishments, and have them reflected in the pay stub.

4. Security Features

Security is crucial when handling payroll and employee data. You need to ensure that both your business’s financial information and your employees’ sensitive details are protected. A paystub generator should offer strong security measures to safeguard against data breaches or unauthorized access.

Key security features include:

- Data encryption: Look for a tool that uses encryption to protect personal and financial data during transmission.

- Two-factor authentication (2FA): To prevent unauthorized access, some paystub generators offer two-factor authentication, which adds an extra layer of security when logging in.

- Secure cloud storage: Many paystub generators offer cloud storage to securely store your pay stubs. This feature ensures that both you and your employees can access pay stubs at any time, without the risk of losing important documents.

5. Employee Access and Delivery Options

A good paystub generator should not only make it easy for you to create pay stubs but also allow employees to access their pay stubs quickly and conveniently. This improves transparency and helps you maintain clear communication with your team.

Look for these employee access features:

- Online employee portal: Some paystub generators offer an online portal where employees can log in and view their pay stubs at any time. This feature is especially useful for remote teams or businesses with multiple locations.

- Email delivery: If an employee prefers to receive their pay stub via email, many paystub generators allow you to email the pay stub directly to the employee.

- Downloadable PDF files: The option to download and print pay stubs as PDFs is essential for employees who prefer physical copies or need to use their pay stubs for personal record-keeping.

6. Integration with Payroll and Accounting Software

As a business owner, you likely already use payroll or accounting software to manage your finances. It’s a huge time-saver if your paystub generator can integrate seamlessly with the systems you’re already using. This eliminates the need to manually input data into multiple platforms and helps streamline your overall workflow.

Look for a paystub generator that:

- Syncs with accounting software: Popular tools like QuickBooks, Xero, and Wave often integrate with paystub generators, making it easier to import data and keep everything in sync.

- Automates recurring payroll: If you have employees on a regular payroll schedule, a good paystub generator can automate the process of creating pay stubs each pay period, ensuring consistency and saving time.

- Tracks employee information: Integration with payroll systems allows you to store and track employee payment histories, which can be helpful for tax filing or future audits.

7. Multi-Employee Support

As your business grows, you may have a larger team of employees to manage. It’s essential that your paystub generator can handle payroll for multiple employees efficiently. Some paystub generators offer bulk upload options or allow you to create pay stubs for multiple employees at once.

Features to consider:

- Bulk generation: A paystub generator that allows you to create pay stubs for multiple employees simultaneously can save you hours of work.

- Employee records: The ability to store and access detailed records for each employee, including their payment history, deductions, and tax information, can be a huge benefit for larger teams.

8. Affordable Pricing

For small businesses, startups, or freelancers, budget is often a concern. Fortunately, many paystub generators offer affordable pricing plans to fit the needs of any business. Some tools are free for basic functionality, while others charge a small fee based on the number of pay stubs generated or the number of employees.

When evaluating pricing, consider:

- Pay-as-you-go or subscription plans: Depending on your needs, you may prefer a pay-as-you-go plan, which charges you per pay stub generated, or a subscription plan that allows you to generate an unlimited number of pay stubs each month.

- Free trials: Many paystub generators offer a free trial so you can test out the features before committing to a paid plan.

Final Thoughts

Managing payroll doesn’t have to be a complex or time-consuming task. A good free paystub generator can help simplify the process, reduce the risk of errors, and ensure your business stays compliant with tax laws. By looking for the features we’ve discussed—ease of use, customization options, tax calculation, security, employee access, software integration, and more—you can find the perfect tool for your business.

Whether you’re a small business owner or a startup entrepreneur, investing in the right paystub generator is an essential step towards making payroll more efficient and manageable. Take your time to research different tools, try out free trials, and choose the one that best suits your needs. With the right tool in place, you can focus on what truly matters—growing your business.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary