Managing payroll can be a daunting task for small business owners, freelancers, and even individuals. With so many things to juggle—like taxes, deductions, and employee information—it’s easy to feel overwhelmed. But what if there was a way to simplify the payroll process, save time, and cut down on costs? That’s where a free paycheck creator comes in.

Whether you’re a small business owner managing payroll for your employees or a freelancer looking to keep track of your earnings, a free paycheck creator can be a game-changer. In this blog, we’ll explore how a free paycheck creator can save you time and money, streamline payroll processes, and help you stay organized.

What is a Free Paycheck Creator?

A free paycheck creator is an online tool that allows you to generate pay stubs and calculate payroll for free. These tools help you quickly determine how much to pay your employees or yourself, based on the hours worked, salary, deductions, and tax rates. Most free paycheck creators come with basic features like calculating gross pay, taxes, and net pay.

For small business owners, freelancers, and even individuals managing their finances, using a free paycheck creator can save a lot of time. Instead of manually calculating taxes and deductions, a paycheck creator does the hard work for you, ensuring that your pay stubs are accurate and compliant with tax laws.

Why Use a Free Paycheck Creator?

The primary reason to use a free paycheck creator is to save both time and money. Let’s dive into the key benefits that make these tools so useful.

1. No Cost for Basic Features

One of the most obvious advantages of a free paycheck creator is that you don’t have to pay for it. Unlike payroll software or services that charge a monthly fee or per-paycheck fee, a free paycheck creator offers basic features at no cost. For small businesses, freelancers, or individuals who have a limited budget, this can be a huge benefit.

Some payroll services can cost hundreds of dollars per year, but a free paycheck creator can do many of the same tasks without the added expense. If you don’t need advanced features like direct deposit or employee management, a free paycheck creator may be all you need to get the job done.

2. Saves Time on Payroll Calculations

Payroll can be time-consuming, especially if you’re trying to calculate taxes, deductions, and overtime manually. A free paycheck creator simplifies this by automatically performing the calculations for you. You just input the basic information—like employee hours, salary, and deductions—and the tool does the rest.

This is especially helpful for small businesses or freelancers who may not have the time or resources to manage payroll manually. Instead of spending hours each pay period figuring out taxes and deductions, you can use the free paycheck creator to instantly generate accurate pay stubs.

3. Ensures Accurate Calculations

When you handle payroll manually, there’s always the risk of making a mistake. A small error in tax calculations or deductions can lead to issues with your employees or even attract penalties from tax authorities. A free paycheck creator helps eliminate these errors by automatically calculating taxes and deductions based on the latest tax rates.

These tools are updated regularly to ensure they reflect current federal, state, and local tax rates, meaning you don’t have to worry about staying on top of changing laws. With a free paycheck creator, you can be confident that your pay stubs are accurate and compliant with tax regulations.

4. Streamlines Payroll for Small Businesses

For small business owners, managing payroll can be overwhelming—especially if you don’t have a dedicated HR or accounting team. A free paycheck creator simplifies payroll by providing an easy-to-use platform that generates pay stubs, calculates deductions, and even tracks year-to-date earnings.

With a free paycheck creator, you don’t need to hire an expensive payroll service or invest in complex payroll software. The tool does all the hard work, freeing up your time so you can focus on growing your business. Whether you have one employee or a small team, a free paycheck creator can make payroll a breeze.

5. Helps Freelancers Track Earnings

For freelancers, keeping track of income and expenses is crucial for managing finances. A free paycheck creator is an excellent tool for freelancers to keep track of their earnings for each project or job, especially if they work with multiple clients.

By using a free paycheck creator, freelancers can quickly generate pay stubs for each paycheck they receive, helping them keep accurate records for tax purposes. This is particularly helpful when tax season comes around, as having organized and professional pay stubs makes filing taxes much easier.

6. Professional and Organized Pay Stubs

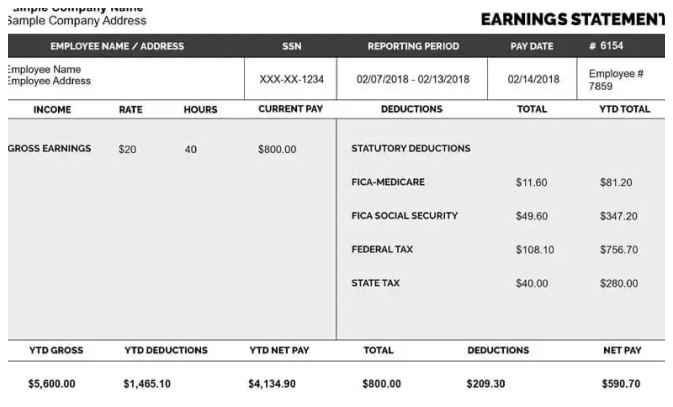

A free paycheck creator ensures that your pay stubs look professional and are easy to read. Pay stubs generated by the tool include all the necessary information, such as:

- Employee name and address

- Pay period (dates worked)

- Gross pay (before deductions)

- Deductions (taxes, insurance, retirement, etc.)

- Net pay (after deductions)

- Year-to-date totals

Having professional pay stubs helps you maintain organized records and provides transparency for your employees. If you’re a freelancer, it also gives your clients a clear breakdown of the work completed and the payment made.

7. Easily Accessible and Convenient

Another great thing about a free paycheck creator is that it’s easily accessible from any device with internet access. Many tools are cloud-based, so you can access them anytime and anywhere. Whether you’re at the office, working from home, or on the go, you can create pay stubs and track payroll whenever you need.

The convenience of using a free paycheck creator makes it an ideal solution for busy business owners, freelancers, and individuals who need a simple way to manage payroll without being tied to one location or device.

8. Keeps You Compliant with Tax Laws

Tax compliance is essential for any business, and mistakes can lead to fines or audits. A free paycheck creator can help you stay compliant by automatically calculating the right amount of federal, state, and local taxes based on your location. These tools are often updated to reflect changes in tax laws, so you don’t have to worry about missing new regulations.

By using a free paycheck creator, you can rest easy knowing that your pay stubs are legally compliant, reducing the risk of costly tax issues in the future.

9. No Need for Payroll Software or Services

If you’re managing a small business or freelancing, you may not need the full capabilities of expensive payroll software. A free paycheck creator provides just the essential features you need to generate pay stubs, calculate taxes, and stay organized without the need for additional services.

Payroll software can often be overkill for small businesses or freelancers with only a few employees or clients, and the monthly or per-paycheck fees can add up quickly. A free paycheck creator gives you the basics without the ongoing costs, making it a cost-effective solution for managing payroll.

How to Choose the Right Free Paycheck Creator

Now that you know how a free paycheck creator can save you time and money, it’s important to choose the right one for your needs. Here are a few things to look for when selecting a tool:

- Ease of Use: Make sure the platform is user-friendly, with an easy-to-navigate interface.

- Customization Options: Look for a tool that lets you customize pay stubs with your company logo or specific employee information.

- Accurate Tax Calculations: Ensure the tool calculates federal, state, and local taxes correctly.

- Security: Choose a tool that prioritizes data security, especially if you’re storing sensitive employee information.

- Mobile Compatibility: If you need to access the paycheck creator on the go, look for one with a mobile app or mobile-friendly interface.

Conclusion

A free paycheck creator is a valuable tool for small business owners, freelancers, and individuals who want to save time, reduce costs, and simplify payroll. With automatic tax calculations, professional pay stubs, and an easy-to-use interface, these tools make managing payroll easier than ever. Whether you’re just starting or looking for a more efficient way to handle payroll, a free paycheck creator can help you stay organized and compliant without breaking the bank. So why not take advantage of this cost-effective solution and streamline your payroll process today?

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal