Pay weekly finance options, also known as weekly payment plans or rent-to-own agreements, provide consumers with the flexibility to spread the cost of purchases over time, typically through manageable weekly installments. While these payment plans can be convenient for those on a tight budget or with limited access to credit, they also come with certain advantages and disadvantages that should be carefully considered before committing to a purchase. Let’s delve into the pros and cons of using pay weekly finance options to help you make an informed decision.

Advantages:

1. Accessibility: Pay weekly finance options are often accessible to individuals with limited credit history or poor credit scores. Unlike traditional financing methods that may require a good credit score or extensive documentation, pay weekly finance plans typically have less stringent eligibility criteria, making them accessible to a wider range of consumers.

2. Flexibility: Weekly payment plans offer flexibility in terms of payment schedules and amounts. Consumers can choose a repayment plan that aligns with their budget and cash flow, allowing them to spread the cost of purchases over an extended period without putting a strain on their finances. This flexibility can be particularly beneficial for individuals with irregular income or fluctuating expenses.

3. No Large Upfront Cost: Pay weekly finance options often require little to no upfront payment, allowing consumers to acquire goods or services without a significant initial investment. This can be advantageous for individuals who cannot afford to pay the full purchase price upfront but still need access to essential items or services.

4. Immediate Access to Goods or Services: By opting for a pay weekly finance plan, consumers can immediately access the goods or services they need without having to save up or wait until they can afford to pay the full amount. This can be especially beneficial in situations where the purchase is time-sensitive or essential for daily living.

5. Opportunity to Build Credit: Some pay weekly finance providers report payment activity to credit bureaus, which means that responsible use of these payment plans can help individuals build or improve their credit score over time. This can be particularly advantageous for those looking to establish a positive credit history or rebuild their credit after past financial challenges.

Disadvantages:

1. Higher Overall Cost: Pay weekly finance options often come with higher overall costs compared to paying upfront or using traditional financing methods. This is because consumers may end up paying additional fees, interest, or markup on the retail price over the course of the payment plan, resulting in a higher total cost of ownership.

2. Risk of Overcommitment: Weekly payment plans may tempt consumers to overcommit financially by purchasing goods or services beyond their means. While the weekly installments may seem manageable at first, failing to budget effectively or encountering unexpected expenses can lead to financial strain or difficulty meeting payment obligations.

3. Limited Selection: Pay weekly finance options may be limited to certain retailers or merchants, restricting consumers’ choices when it comes to purchasing goods or services. This can be frustrating for individuals who prefer to shop at specific stores or have particular preferences in terms of brands or product features.

4. Potential for Repossession: In some cases, failure to make timely payments on a pay weekly finance plan can result in repossession of the purchased goods or services. This means that consumers risk losing access to the items they’ve acquired if they fall behind on payments, which can have significant consequences, especially for essential items such as furniture or appliances.

5. Impact on Credit Score: While responsible use of pay weekly finance options can help build credit, missed or late payments can have a negative impact on credit scores. This can hinder consumers’ ability to access credit in the future and may result in additional fees or higher interest rates on future loans or credit cards.

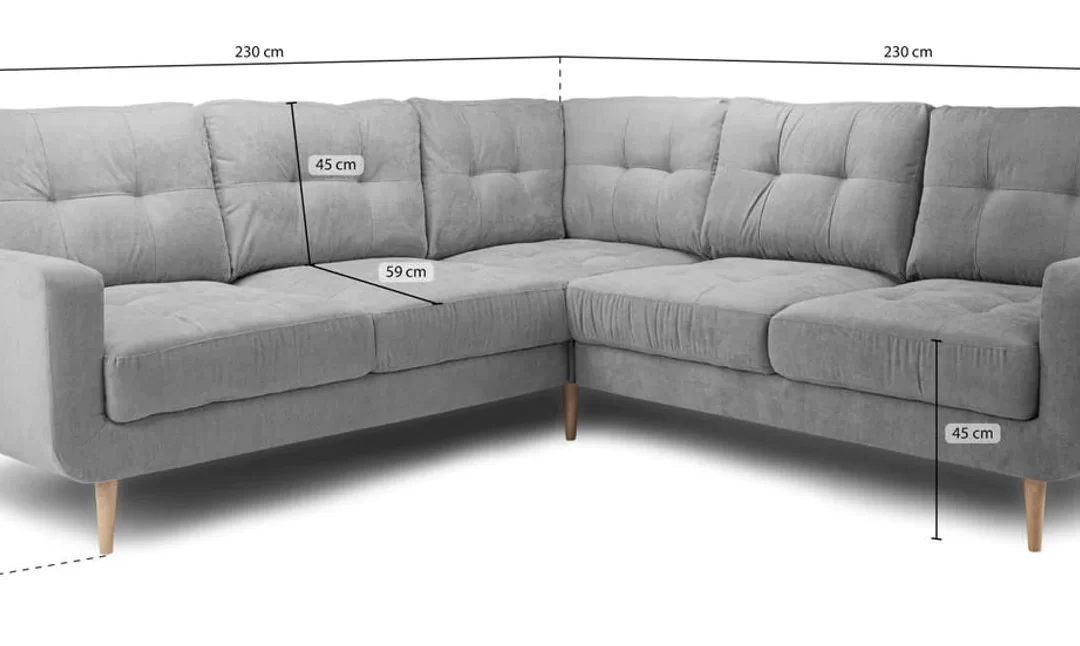

For more information and interested to see more designs and collection of sofas then visit official site Cheap Furniture Store.

Conclusion:

Pay weekly finance options offer both advantages and disadvantages for consumers seeking to spread the cost of purchases over time. While these payment plans provide accessibility, flexibility, and immediate access to goods or services, they also come with higher overall costs, potential risks of over commitment, and limitations in terms of selection and credit impact. Before opting for a pay weekly finance plan, it’s essential to carefully assess your financial situation, consider alternative payment methods, and weigh the pros and cons to make an informed decision that aligns with your needs and budgetary constraints.